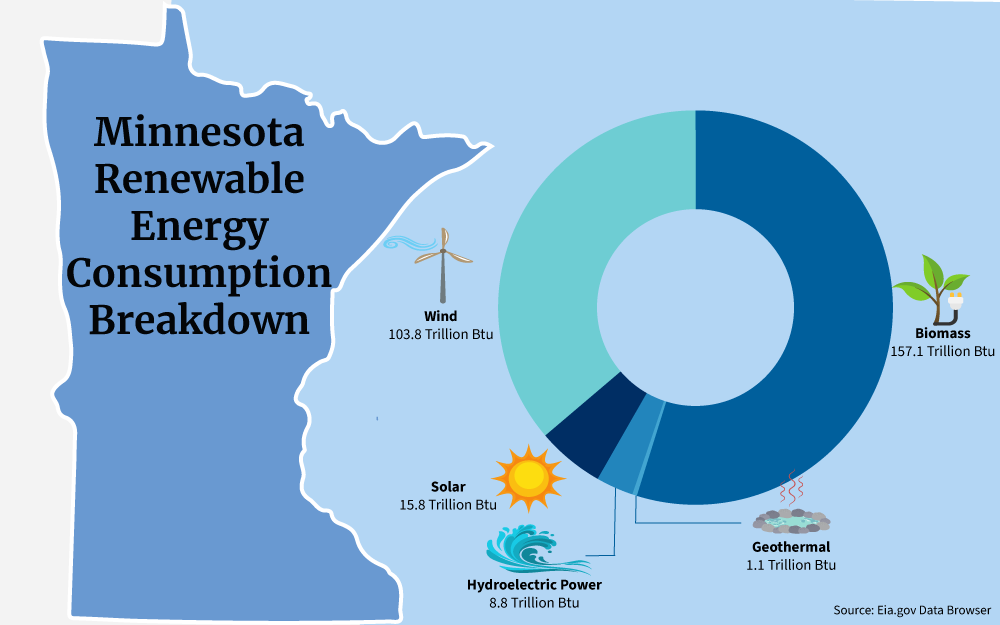

Minnesota offers residents and businesses clean energy incentives to install solar panels and invest in clean energy vehicles.

In combination with federal tax credits for green energy, the cost of any new equipment installed can qualify.**

TAX INCENTIVE NOTICE*

**Fraud Alert**

US Green Energy

Click Here to Sign Up for Free Solar Panel Installation

| Schedule | Acceptance Date | Last Day To Register |

|---|---|---|

| Q1 | Monday January 1, 2024 | March 30, 2024 |

| Q2 | Monday April 1, 2024 | June 30, 2024 |

| Q3 | Monday July 1, 2024 | September 30, 2024 |

| Q4 | Tuesday October 1, 2024 | December 30, 2024 |

| Q1 (2025) | Wednesday January 1, 2025 | March 30, 2025 |

Energy Storage Incentives

PLEASE NOTE: Beginning in 2025, the federal tax incentives for solar residential installation will be impacted. See the table below for the dates and amounts currently legislated.

**The Federal tax credit is available every year that new equipment is installed.

Minnesota Government

Office of Governor Tim Walz & Lt. Governor Peggy Flanagan

130 State Capitol

75 Rev Dr. Martin Luther King Jr. Blvd.

Saint Paul, MN 55155

Phone: 651-201-3400

Toll Free: 800-657-3717

Relay: 800-627-3529

Hours: 9:30am – 3:30pm

Xcel Energy

414 Nicollet Mall

Minneapolis, MN 55401

Residential Customer Service

(800) 895-4999

Hours: M-F 7am – 7pm

Saturday: 9am – 5pm

Minnesota Department of Commerce – Division of Energy Resources

85 7th Place East

Suite 280

Saint Paul, MN 5510

(651) 539-1500

[email protected]

Monday – Friday

9:00am – 5:00pm, subject to change

Duluth Weather Bureau

5027 Miller Trunk Highway

Duluth, MN 55811-1442

(218) 729-6697

[email protected]

Hours: Open Daily, 24 hours

Clean Energy and Vehicle Federal Tax Credits

Business Federal Tax Credits

State Tax Credit and Rebate Schedule

| Year | Credit Percentage | Availability |

|---|---|---|

| 2024-2032 | 30% | Individuals who install equipment during the tax year |

| 2033 | 26% | Individuals who install equipment during the tax year |

| 2034 | 22% | Individuals who install equipment during the tax year |

| 2024 | $0.03 per kWh and an up-front incentive for income-qualified systems | Individuals who install equipment (subject to approval of interconnection application) |

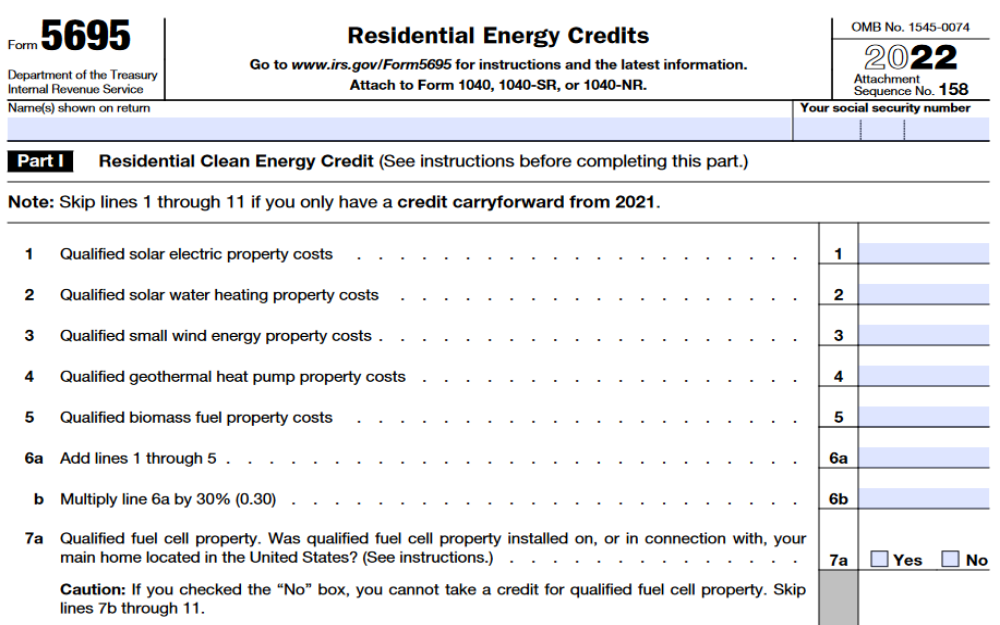

If you have determined that you are eligible for the green energy credit, complete Form 5695 and attach to your federal tax return (Form 1040 or Form 1040NR).

IRS Form 5695

Instructions

Future Due Dates and Basics

Office of Energy Efficiency & Renewable Energy

Forrestal Building

1000 Independence Avenue, SW

Washington, DC 20585

RESIDENTIAL CLEAN ENERGY TAX CREDIT

Minnesota Clean Energy

Minnesota’s Climate Action Framework

Energy Conservation and Optimization

Home Energy Guide

Energy Assistance Program Providers

Solar for All

Electric Vehicle Rebates

Email

Power Outage Map

Minnesota Department of Administration

Phone: (651) 201-2562

Email: [email protected]

200 Administration Building

50 Sherburne Avenue

Saint Paul, MN 55155

With numerous alternatives for residents and businesses are available, Minnesota solar incentives are designed to decrease the cost of solar panel installation in the state and encourage the adoption of green energy standards.

Federal, state and local government programs are open for registration for residents, homeowners, and businesses to adopt solar power and other green energy options.

Minnesota Solar Energy Incentives Background

Currently, the state ranks seventeenth is solar adoption, but that number is changing as more people recognize that with Minnesota solar incentives, a solar energy system offers long-term rewards, delivering equity, reduced utility expenses, and lower energy emissions.

This guide outlines the rebates, programs, and credits Minnesota has to offer, and breaks down the real costs of a solar panel in the United States, as well as savings you can enjoy by moving some or all of your energy needs off the grid.

How Do Solar Credits Work in Minnesota?

Minnesota solar incentives offer options for residents that are comparable to options in Texas and Florida.9

There are 5 primary incentive varieties for Minnesotans seeking solar solutions.8 These include rebates, incentives, loans, and the C-PACE initiative (Commercial Property-Assessed Clean Energy).

These programs are primarily offered by the state government to encourage residents to switch to alternative clean energy sources for environmental and economic gains.

Each of these Minnesota solar incentives is explored in this section.

Energy Efficiency and Solar Rebates in Minnesota

The Conservation Improvement Program, CIP, is available statewide.7 It’s managed through utility companies providing electric options and natural gas.

For solar, rebates exist for businesses that demonstrate improvements in energy efficiency. You can acquire consultation on new renewable alternatives that feature rebates to inform your choice in Minnesota solar.6

An example is the Rochester Public Utilities option for Photovoltaic or PV solar arrays.20

If your system qualifies, you get a $500 rebate. Eligibility requires net metering and interconnection with Rochester public utilities.

You also need to have an audit prior to installation. It’s all first-come, first-serve, and the program could end any time so acting soon is best.

The city of Owatonna also offers this rebate, as well as a solar water heating option at $15 per square foot up to $1,200.19 The City of Austin has similar options.13

To acquire such rebates, contact cities or companies offering them and fill out associated application forms.

Incentives Available for Solar in Minnesota

Minnesota Power offers a .29 cent rebate per kilowatt which is subject to specific calculations as determined by Minnesota Power. It’s a net metering option and is centered around excess solar produced outside localized residential needs throughout the year.17

The option is available for systems designed with a capacity of up to 20 kilowatts. Such a system could conceivably produce up to 80 kWh (kilowatt hours) a day.

If you used half of those, you might be averaging $4,000 or more a year in rebates. Xcel Energy, currently one of the largest solar farms in Minnesota, offers something similar.18

As of 2023, there were 131 total renewable incentive programs available in MN.15 Not all of those are a government solar panel program, but there are quite a few that are.

It’s currently ranked 17th among the US states in terms of solar capacity and the reason could be that, by law, it’s required that no less than 10% of all energy sales in the state be solar-related by 2030. The state has a legal prerogative to encourage residents to make this transition.

To get this rebate, you’ll need to contact Minnesota Power and fill out the paperwork they provide.

Net Metering Options

Minnesota net metering requires your system not to generate more than 120% of the needed energy. If your home used 10 kilowatts a day on average, your system would need to be no larger than 12 kilowatts at base level.

It may generate well over 120% of your need, but it can’t be designed higher than the 120% rate.16

To pursue net metering for your array, you’ll need to contact associated utility companies and fill out the paperwork they provide. Shop around for the best deal.

Loan Options: PACE and Otherwise

Farmers considering solar may be eligible for loans to acquire and install associated equipment.14 The loan can be used to purchase up to 80% of total equipment and associated installation.

Different terms apply to groups and individuals. Associated loans are for a 10-year term at 2% interest.

Provided your solar energy or water heating apparatus replaces previous energy needs, you would basically be paying a similar amount, only now your payment goes to those managing the loan, rather than the utility company. You can coast for a decade with only a 20% up-front payment.

The Commercial Property-Assessed Clean Energy program (C-PACE) also makes a variety of loans available for businesses under a variety of term arrangements dependent on the scope of a given project.

It’s a tax-neutral option that similarly allows those it serves to “alternate” utility bills.10 Instead of paying “X” amount for traditional energy, you install solar under C-PACE loans and have a loan payment instead of a utility bill.

Contact C-PACE offices to determine what paperwork you need, and what determines eligibility for financing. What you can get will differ per person, or per organization.

Sales Tax and Property Tax Exemptions

Solar electric and heating options are free of sales tax in Minnesota.28 There also aren’t property taxes for such home additions.

On the sales tax side, this saves 6.88% on each purchase. A $20,000 solar array would require an additional $1,376.00 in sales tax that Minnesotans don’t have to pay.

On the property side, added equity through solar renewables won’t initiate increased taxes.

Property tax in MN is 1.05%, meaning without this provision, a $20,000 solar array would cost an extra $210 a year.12 With this exemption, you save $1,050 every 5 years.

ITC and PTC Tax Credit Options

At the federal level, Minnesota solar credits can fall under ITC or PTC.

The Investment Tax Credit

The ITC tax credit basically makes it so 30% of your solar installation costs can be claimed against federal income tax.25 So if your system costs $20,000, and your taxable income for the year was $40,000, you would be able to subtract $6,000 from your annual taxable income, dropping the burden for which you must pay taxes to $34,000.

If you’re curious about what is the maximum solar tax credit? The good news is there is no cap to the aforementioned 30 percent.

It is important to note, however, that there are a number of requirements to be eligible for this tax credit program. For instance, only new PV systems are allowed and used solar panels are not.

This is available until 2033. To apply, fill out a federal solar tax credit form or IRS 5695 form and include it with your annual taxes.27

Step 1: Obtain the Form

Download Form 5695 from the official IRS website or obtain a physical copy from the IRS or your tax preparation software.

Step 2: Verify Eligibility

Ensure that you are eligible for the federal solar tax credit. Generally, this credit is available for residential solar energy systems installed in your primary residence.

Step 3: Gather Documentation and Information

Collect all relevant documents and information, including receipts, records, and any supporting documentation related to the cost and installation of your solar energy system.

Step 4: File Your Tax Return

If you’re filing electronically, follow the instructions provided by your tax software or e-filing service. If you’re filing a paper return, make sure to attach Form 5695 and any supporting documents.

The Production Tax Credit

The PTC, or Production Tax Credit, is available on a “per kilowatt-hour” basis for all electricity from solar (as well as other technology that qualifies) during a system’s first 10 years.

Tax liability at the federal level is reduced, and there are annual inflation adjustments, too. You get to excise “X” amount from your annual tax liability based on how many kWhs are produced.26

To apply, fill out an IRS 8835 form and include it with your annual taxes.4

- Obtain the Form: Visit the official IRS website and search for “Form 8835” to download the latest version of the form.

- Review the Instructions: The IRS provides detailed instructions for each form. Read through the instructions to understand who needs to file this form and under what circumstances.

- Gather Necessary Information: Collect all the information and documentation needed to complete the form. This may include information about the employer and employees, as well as any qualified research expenses.

- Complete the Form: Follow the instructions provided and fill out the form accurately. Take note of the specific lines and boxes that should be completed based on your situation.

How To Apply for Solar Credits and Rebates in Minnesota

Some solar credits and rebates require you to apply in advance of installation, some can be attained after the fact provided you’re able to demonstrate your system works and is contributing to renewable energy solutions for the state.

We covered how to apply for such incentives in the “How do solar credits work in Minnesota?” section of this guide. Essentially, contact organizations offering rebates or other incentives, they’ll direct you to the proper forms.

Selling Solar Power to Minnesota: Process Explained

Net metering and Power Purchase Agreements (PPAs) allow you to sell excess energy back to the state through power companies.

PPAs

With a Minnesota PPA, a solar developer installs, owns, and maintains whatever array is on your property. You simply agree to purchase electricity from that system for 10 to 25 years.5

Different localized companies offer different PPA options. So how do you acquire such a PPA?

You’re going to have to contact different solar and utility companies to see what they offer, weigh those offerings, and decide which best works for you.

Net Metering

You can sell energy produced by your own solar array to the power companies in your area at a rate per kilowatt, usually .29 cents for extra kilowatts above your actual need. Contact associated utility companies, determine what they’ll offer, explore their method of implementing net metering, and decide which alternative matches your needs.

This option pays directly, but you’re responsible for installing the solar array, so there’s a tradeoff in contrast to PPA in MN.

For either, time is the key ingredient to seeing profit. Be sure to think in terms of decades for best results.

Installing Home Solar System: Steps

Solar energy installation is straightforward. Here are the basic steps:

1. Determine a Property’s Annual Energy Needs

Examine what you’re spending annually on electricity, and divide that per season to determine exact usage.

In Minnesota, an average household spends $153 a month on energy, or $1,836 a year.3 That comes out to roughly 17 cents per kWh.

2. Explore What Solar Energy Alternatives Will Cover Those Needs

The average Minnesotan uses 900 kWh per month, or 10,800 a year. Most solar arrays will need that level of production.

That means you’ll probably want a solar energy array that represents, at minimum, 7.5 kilowatts of productive potential. This should produce 28 to 40 kWh per day; more than enough to cover your average monthly needs.23

3. Allocate Space for a Solar Array To Match Recurring Needs

Most 500-watt solar panels require around 27.5 square feet.1 For 7.5 kilowatts, that’s 412.5 square feet or about a 20.3 by 20.3-foot square area.

You don’t have to use a “square” space and most homes have this much roof area, although not all do. Some arrays may need to be ground-based and networked into the property’s energy infrastructure.

4. Research Solar Options, Consult With Professionals To Confirm

Once you’ve done all this groundwork, contact multiple solar providers to determine if you got the details right.

You definitely want to bring a little information to the table. Not all solar providers offer the same level of service, and you need to discern which ones are most trustworthy.

5. Decide if the DIY Route or the Professional Route Is Best

You need a space for your array, enough panels, mounts, cords to transfer power, surge controllers, a battery array to store energy like a reservoir, and a power inverter to connect a property’s electric infrastructure.

There are DIY kits available in the market and you can always google how to make a solar cell or terms like “photovoltaics definition” or “how PV systems work” in order to better understand how to install it on your own.

However, DIY options may expose you to hidden complications as not all solar kits have the same quality. Sometimes you’ll want to work with pros just to save yourself money on the back-end.

Now comes the question, “How long do solar panels last?”

A cheap kit may work for years, but will likely have issues within 10. A strong array should last 25 to 30 years, only requiring you to sub out panels rarely with proper maintenance.

So, how long will solar panels last depends on their quality. Spending more upfront saves you money on the back end.

You can acquire DIY solar installation kits for around $1,200 per kilowatt. The average cost of solar in MN is $3.43 per Watt, which would be $3,430 for a 1-kilowatt system including installation.2

6. File Loans or Grant Applications for Equipment and/or Installation

Present your solar energy research to loan and grant organizations. When you’ve got the numbers readily available, and you can explain your reasoning behind them, there’s a higher likelihood you’ll secure needed funding.

Get the balance right, and you’ll just replace your utility bill for a loan payment.

7. Install and Monitor the New System’s Energy Production

Now that you have the equipment, the professionals, the loan, or all three, it’s time to mount your system and make it work. Carefully monitor your array after installation to ensure it’s producing energy matching needs and is reliable.

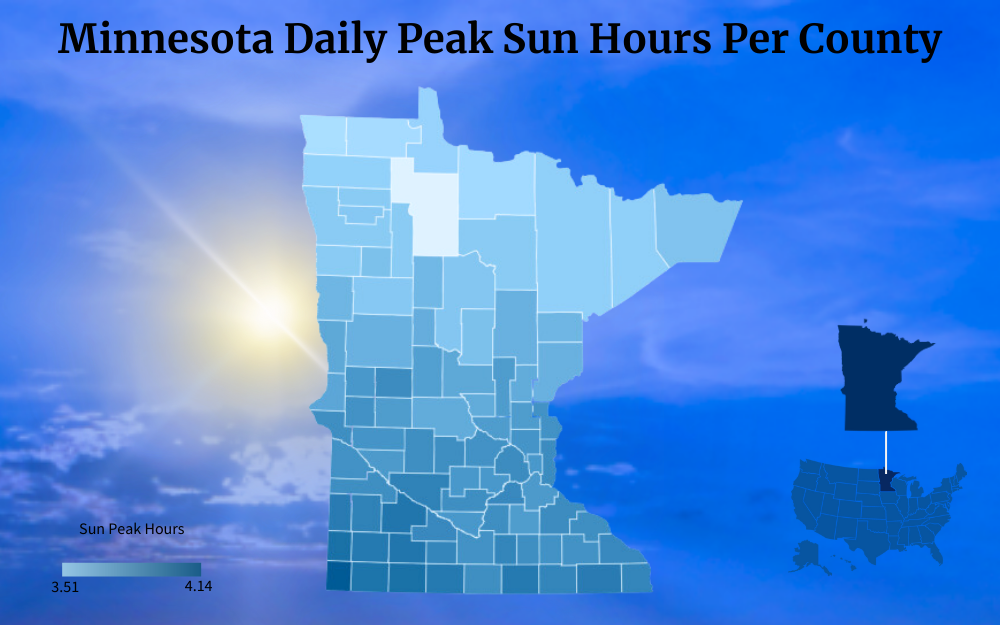

It is best to know how much sunlight your solar panels may receive according to where you are located in order to set expectations.

For this reason, setting up solar panels is best done in early spring or summer. Also, your array should be installed somewhere that doesn’t make maintenance too challenging.

If you’re wondering how long can solar panels last without sun, no need to worry because solar panels can still produce energy without direct sunlight as the PV system uses photons or light particles to do this. Your panels will still work even in partial shade or cloudy days.

How To Use a Residential Solar Panel Calculator

A few hours’ calculation on the front end could be thousands of dollars in profit on the back end. Consider these variables as you go about calculating solar costs, savings, and potential profits:

- Costs involved in acquisition and installation of solar tech

- Expense reduction through varying incentives

- Utility bill deferral through solar energy

- Property value enhancement

- Associated sales taxes

Costs Involved in Acquisition and Installation of Solar Tech

Minnesota solar averages $3.43 per Watt. That includes installation, and assumes you do not go the DIY route.

Going the DIY route, you can acquire equipment for as little as $1.20 per Watt.

With those numbers, proper installation will average $25,725 for a 7.5 kilowatt system, or $9,000 if you go the DIY route.

You can always find a solar energy estimator online to make this step easier.

Expense Reduction Through Rebates and Net Metering

There’s a $500 solar rebate available across most of MN. With a 7.5 kilowatt array, you can expect to produce about $500 in excess power for which you’ll also receive a sort of “net metering” rebate.

Round savings to about $1,000 in this area. There are also loan options and PTC options at the federal level, but these vary, and will be unique to the business or individual installing solar.

Factor such information in once you’ve crunched the other numbers.

Utility Bill Deferral Through Solar Energy

The average utility cost for electricity in Minnesota is $1,836 a year. You can cut that out with a properly-installed solar circuit, even producing electricity in excess of your need.

If you do that, be sure to explore net metering.

Property Value Enhancement

The average home in MN is worth $331,869.29 That’s around $3,484.63 in annual tax at the 1.05% property tax rate. If you didn’t get the exemption on your panel installation, you’d have to pay something like $270.12 in taxes (that number comes from assuming a $25,000 or more solar array represents a 1 for 1 value increase on your property).

With the exemption, the average Minnesotan will save around $270.12 a year, but their home will likely increase in value regardless. So you’ll be taxed for $331,869, but you could potentially have a property now valued at $357,594 or more.

Associated Sales Taxes

You want to figure out what you can cut from costs through incentives. The ITC credit allows you to claim 30% of total solar array expenses from taxes, so that’s $7,717.5 you can extract from taxable income for a 7.5-kilowatt array at the $25,000+ amount assumed here.

If you make $50,000 a year, subtracting $7,717.50 from your taxable income will drop you to $42,282.50 of taxable income, putting you in the 12% tax bracket. This will differ substantially from person to person.

In this particular hypothetical instance, a 7.5-kilowatt solar array would save you over $5,000 in the year you install your array.

Also, you can extract sales tax at a rate of 6.88%. So a system for which you paid $25,725 would have cost $27,625.75 before the sales tax reduction.

Combining All Variables To Calculate Savings Over the Long-Term

At $25,725 for 7.5 kilowatts of raw productive potential, you’ve already saved $1,900.75 in sales tax.

At an income of $50,000 a year, a new solar array eligible for the ITC tax credit would save you about $5,000, in total, by knocking you down a tax bracket. This number will vary widely, but we’ll just put that down as an average “baseline” figure.

So now you’ve saved $6,900.75, and your net worth has only been reduced by $20,725.

Next, you’ll save something like $270.12 a year in equity tax, so you’re down to $20,454.88.

You can also defer your annual utility bill, meaning you’re down to $18,618.88 in the first year. Subtract another $1,000 for net metering and rebates.

Now you’re down to $17,618.88.

An initial investment of $25,725 will have a “real” cost of $17,618.88 in the first year. From there, you save $270.12 in equity tax and $1,836 a year in utility bill deferral, for a combined annual savings of $2,106.12.

Before you factor in equity, your panels totally pay for themselves within 8.4 years, at which point they generate $2,106.12 in savings every year going forward.

When you factor in equity, you actually don’t lose anything. That $25,725 you spend will increase your home’s equity between $13,000 and $25,725, depending.24

Of that $17,618.88 spent on installation, on average, you only diminish net worth by $2,618.88 in the first year. By the second, you’ve earned $4,112.24 in savings from deferred equity tax and utility bills.

That means somewhere in the middle of your second year, you start to profit in terms of net worth expansion in Minnesota. You won’t see those savings hit your wallet until 8.4 years after you install, but your net worth jumps directly within 2 years.

Sell after you cross that threshold, and see the profit directly.

Contractor Requirements for Home Solar System Installation

Read online reviews to determine what locals think of a given contractor you’re considering. Call multiple contractors to compare rates.

Never trust a recommendation solely on its own merit. Long-term financing is a risky proposition if panels aren’t qualitative.

Ask around to see which contractors do a job that lasts at least 10 years without big issues.

Informing Your Choice of Renewable Energy in Minnesota

Why are solar panels good for the environment? Simply because it mitigates climate change by reducing greenhouse gas emissions.

This is why the local government pushes for better access to solar energy and continues to support more solar installations across the state.

But to fully take advantage of the benefits of solar energy for our planet, solar panels sustainability including proper solar panel disposal must always be observed.

You can see increased worth through solar energy on your property in Minnesota.

Energy demand in the state is higher given the climate, meaning it can take longer for you to see a return, but it has some of the most robust incentive packages. If you haven’t looked into Minnesota solar incentives and programs, check out the energy saving you could be earning with solar.

Frequently Asked Questions About Minnesota Solar Incentives

Do Minnesota Solar Panels Have To Be Roof-Mounted?

HOAs and available space determine whether you should roof-mount an array. If your roof space can’t allow it, however, you also have the option of installing wall-mounted solar panels.

How Many Minnesota Residents Have Solar?

Over 260,000 homes in Minnesota use solar energy.22 There are approximately 5.707 million people in Minnesota,11 so at a household average of 3 persons per home, 1 in 7 to 1 in 8 people in Minnesota utilize solar power.

How Long Can Solar Panels Go Without Sun in Minnesota?

A 10 kWh battery will last about 24 hours without input from the sun.21 1 battery lasts 24 hours without sunlight so if you’ve got 7, you can last a week. It will depend on your battery array, basically.

References

1Dearing, P. (2023, February 6). Solar Panel Size And Weight Explained: How Big Are Solar Panels? Solar Energy World. Retrieved September 4, 2023, from <https://www.solarenergyworld.com/solar-panel-size-and-weight-explained-how-big-are-solar-panels/>

2EnergySage. (2023, March 15). Solar Panel Cost in Minnesota. EnergySage. Retrieved September 4, 2023, from <https://www.energysage.com/local-data/solar-panel-cost/mn/>

3EnergySage. (2023, August 27). Cost of electricity in Minnesota. EnergySage. Retrieved September 4, 2023, from <https://www.energysage.com/local-data/electricity-cost/mn/>

4Internal Revenue Service. (2023, April 14). About Form 8835, Renewable Electricity Production Credit. Internal Revenue Service. Retrieved September 4, 2023, from <https://www.irs.gov/forms-pubs/about-form-8835>

5Kelly, S. (2023, May 3). How to Get Free Solar Panels Installed in Minnesota. EcoGen America. Retrieved September 4, 2023, from <https://ecogenamerica.com/free-solar-panels-minnesota/>

6Minnesota Chamber of Commerce. (2023). Energy Smart. Minnesota Chamber of Commerce. Retrieved September 4, 2023, from <https://www.mnchamber.com/your-opportunity/energy-smart>

7Minnesota Department of Commerce. (2023). Conservation Improvement Program. Minnesota Department of Commerce. Retrieved September 4, 2023, from <https://mn.gov/commerce/energy/industry-government/cip/>

8Minnesota Department of Commerce. (2023). Financial Assistance. Minnesota Department of Commerce. Retrieved September 4, 2023, from <https://mn.gov/commerce/energy/industry-government/financing-energy/>

9Minnesota Department of Commerce. (2023). Solar Energy for Homes. Minnesota Department of Commerce. Retrieved September 4, 2023, from <https://mn.gov/commerce/energy/solar-wind/solar-for-homes/>

10MinnPace. (2023). Minnesota PACE Financing. MinnPace. Retrieved September 4, 2023, from <https://minnpace.com>

11MN State Demographic Center. (2023). Census 2020. MN State Demographic Center. Retrieved September 4, 2023, from <https://mn.gov/admin/demography/data-by-topic/population-data/2020-decennial-census/>

12Mortgage Research Center. (2023). Highest & Lowest Property Tax States. Mortgage Calculator. Retrieved September 4, 2023, from <https://www.mortgagecalculator.org/helpful-advice/property-taxes.php>

13N.C. Clean Energy Technology Center. (2023, March 7). Austin Utilities – Solar Rebate Program. DSIRE. Retrieved September 4, 2023, from <https://programs.dsireusa.org/system/program/detail/4333/austin-utilities-solar-rebate-program>

14N.C. Clean Energy Technology Center. (2022, October 13). Farm Opportunities Loan Program. DSIRE. Retrieved September 4, 2023, from <https://programs.dsireusa.org/system/program/detail/3395/farm-opportunities-loan-program>

15N.C. Clean Energy Technology Center. (2023). Minnesota renewable energy and energy efficiency. DSIRE. Retrieved September 4, 2023, from <https://programs.dsireusa.org/system/program/mn>

16N.C. Clean Energy Technology Center. (2023, February 22). Net Metering. DSIRE. Retrieved September 4, 2023, from <https://programs.dsireusa.org/system/program/detail/282/net-metering>

17N.C. Clean Energy Technology Center. (2023, March 7). Minnesota Power – SolarSense Solar Rebate Program. DSIRE. Retrieved September 4, 2023, from <https://programs.dsireusa.org/system/program/detail/1092/minnesota-power-solarsense-solar-rebate-program>

18N.C. Clean Energy Technology Center. (2023, March 7). Xcel Energy – Solar*Rewards Program. DSIRE. Retrieved September 4, 2023, from <https://programs.dsireusa.org/system/program/detail/5417/xcel-energy-solar-rewards-program>

19N.C. Clean Energy Technology Center. (2023, June 23). Owatanna Public Utilities – Solar Rebate Program. DSIRE. Retrieved September 4, 2023, from <https://programs.dsireusa.org/system/program/detail/4334/owatanna-public-utilities-solar-rebate-program>

20N.C. Clean Energy Technology Center. (2023, June 23). Rochester Public Utilities – Solar Rebate Program. DSIRE. Retrieved September 4, 2023, from <https://programs.dsireusa.org/system/program/detail/4331/rochester-public-utilities-solar-rebate-program>

21Ost, I. (2023, June 1). How Long Can Solar Battery Power a House During an Outage? Solar.com. Retrieved September 4, 2023, from <https://www.solar.com/learn/how-long-can-a-battery-provide-power-during-an-outage/>

22Ritchie, C. (2023, July 27). Best Solar Panel Installation Companies in Minnesota. CNET. Retrieved September 4, 2023, from <https://www.cnet.com/home/energy-and-utilities/minnesota-solar-panels/>

23ShopSolar. (2023). How Much Power Does a 7kW Solar System Produce Per Day? ShopSolar. Retrieved September 4, 2023, from <https://shopsolarkits.com/blogs/learning-center/how-much-power-does-a-7kw-solar-system-produce-per-day>

24Solar Energy Technologies Office. (2023). Homeowner’s Guide to Going Solar. Office of Energy Efficiency & Renewable Energy. Retrieved September 4, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-going-solar>

25Solar Energy Technologies Office. (2023, March). Homeowner’s Guide to the Federal Tax Credit for Solar Photovoltaics. Office of Energy Efficiency & Renewable Energy. Retrieved September 4, 2023, from <https://www.energy.gov/eere/solar/homeowners-guide-federal-tax-credit-solar-photovoltaics>

26Solar Energy Technologies Office. (2023, August). Federal Solar Tax Credits for Businesses. Office of Energy Efficiency & Renewable Energy. Retrieved September 4, 2023, from <https://www.energy.gov/eere/solar/federal-solar-tax-credits-businesses>

27Wakefield, F., & Addison, T. (2023, July 9). Minnesota Solar Tax Credits, Incentives and Rebates (2023). MarketWatch Guides. Retrieved September 4, 2023, from <https://www.marketwatch.com/guides/home-improvement/minnesota-solar-incentives/>

28Zagame, K., & Neumeister, K. (2023, August 28). Do Minnesota Solar Incentives Make It Affordable for Homeowners to Go Solar? EcoWatch. Retrieved September 4, 2023, from <https://www.ecowatch.com/solar/incentives/mn>

29Zillow. (2023). Minnesota Home Values. Zillow. Retrieved September 4, 2023, from <https://www.zillow.com/home-values/31/mn>

30Screenshot from IRS. Internal Revenue Service. Retrieved from <https://www.irs.gov/pub/irs-pdf/f5695.pdf>

31Photo by Northfield, MN. Northfield, MN. Retrieved from <https://www.northfieldmn.gov/1379/Solar-Energy>